oregon workers benefit fund tax rate

Oregon Workers Benefit Fund Payroll Tax Overview. Workers Benefit Fund Assessment Oregon Administrative Rules Chapter 436 Division 070 Effective Jan.

Oregon Workers Benefit Fund Payroll Tax

The workers benefit fund assessment rate will be 22 cents per hour in 2023.

. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. This assessment is calculated based on employees per hour worked. Oregon workers are subject to Workers Benefit Fund WBF assessment tax.

You are responsible for any. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under. Oregon workers benefit fund tax rate Saturday June 18 2022 Edit.

These coronavirus stimulus checks from Oregon however would go only to low-income workers. 653026 Nonurban county defined for ORS. If a taxpayer would have met the 90 threshold under the prior years rate 145 for tax year 2020 but does not meet the 90 threshold under the new BIT rate 200 quarterly interest.

Go online at httpswww. Oregon Workers Benefit Fund Assessment Report. What is the Oregon WBF tax rate.

For 2019 our analysts. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers. NE Salem Oregon 97301.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. You are responsible for any. Prescribe the rate of the Workers Benefit Fund assessment under ORS 656506.

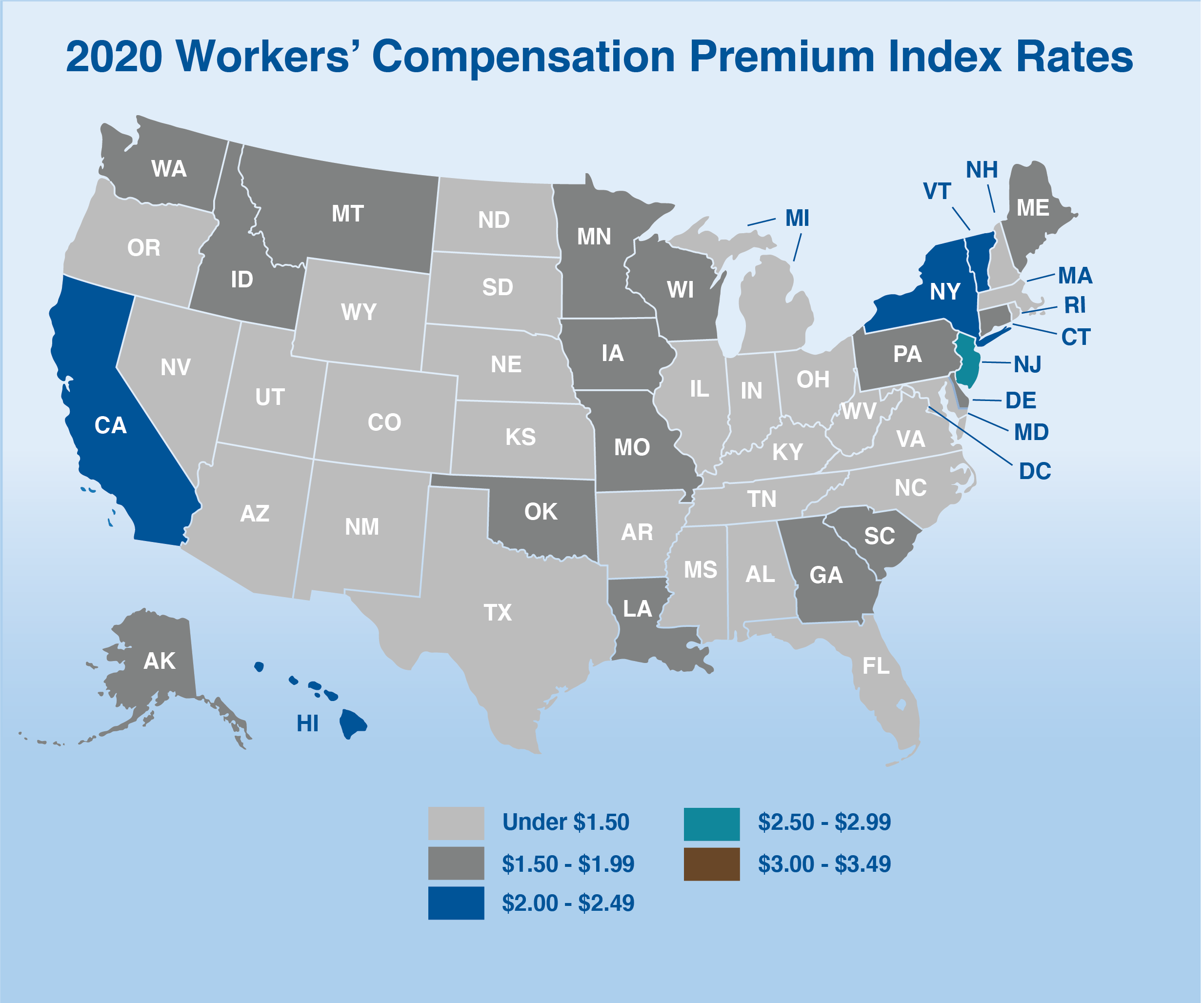

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021. Oregon workers compensation costs already among the lowest in the nation will drop in 2022 for the ninth-straight year. Prescribe the rate of the Workers Benefit Fund assessment under.

Oregon Combined Tax Payment Coupons Form OR-OTC arent in this booklet. 84 percent decrease 2019. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation.

For 2022 the rate is 22 cents per hour. Color-coded maps of the US. The Oregon Workers Benefit Fund WBF.

The detailed information for Oregon Wbf Assessment Rate 2020 is provided. Ranking of each states workers. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee.

The program will feature a fund that starting in September 2023 will pay benefits to Oregon workers who need to take time off to care for a sick family member or after a birth. Oregon Workers Benefit Fund Payroll Tax Overview. The detailed information for.

They were sent separately to employers in De-cember of. The Oregon workers compensation payroll assessment rate will not change in 2023. 3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

Pandemic Profits Netflix Made Record Profits In 2020 Paid A Tax Rate Of Less Than 1 Percent Itep

Oregon Paycheck Calculator Adp

Workers Compensation Overview And Issues Everycrsreport Com

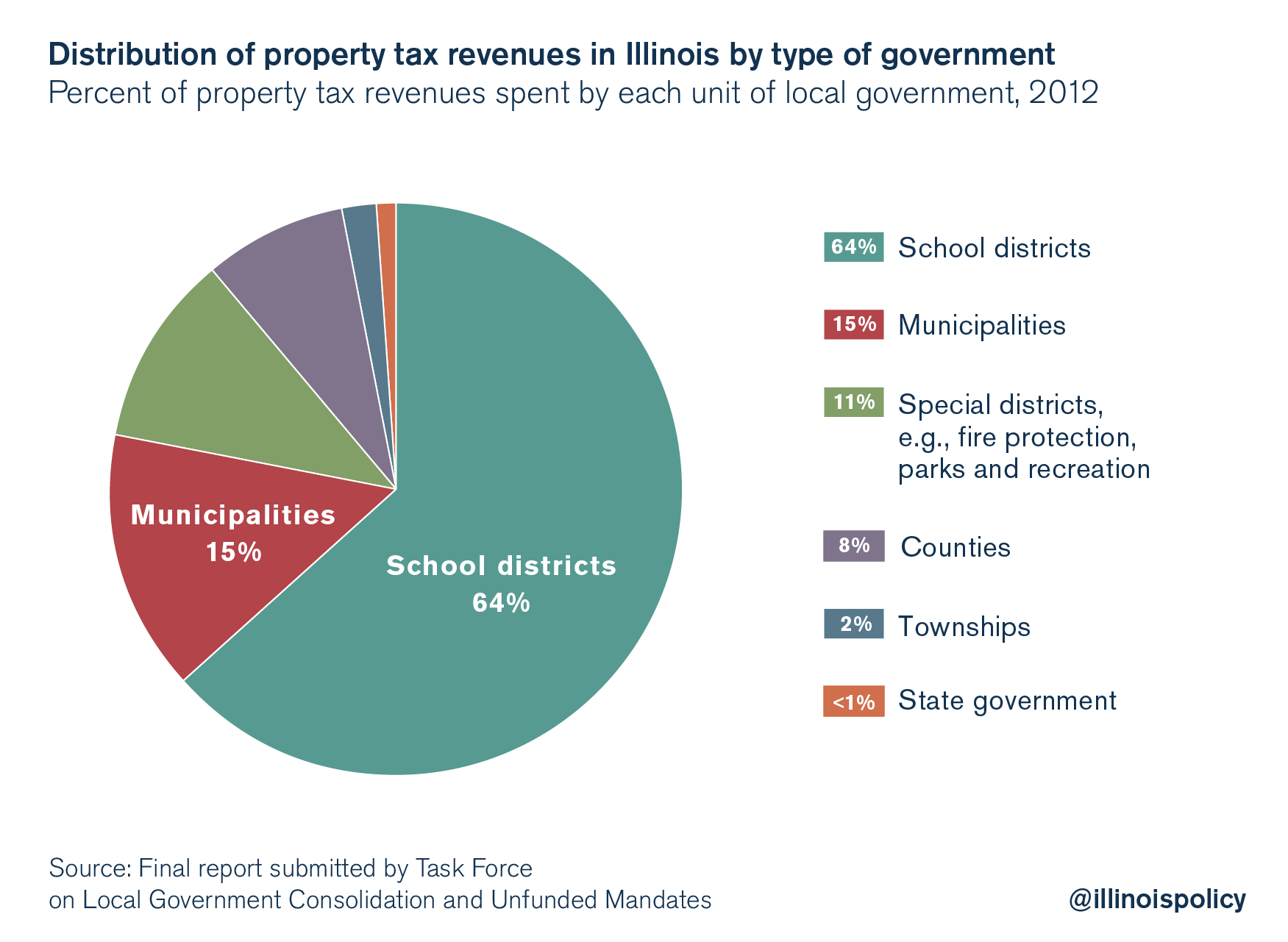

Workers Compensation Estimated To Cost Illinois Taxpayers Nearly 1 Billion Per Year Illinois Policy

Workers Compensation Rates In Oregon

Workers Compensation Rates Explained 2020 Workers Comp Rates

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

How Are My Workers Compensation Benefits Calculated Kbg Injury Law

Oregon Labor Laws The Complete Guide For 2022

Payroll Tax Calculator For Employers Gusto

Employers Have You Heard About Chehalem Valley Chamber Facebook

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

Benefits Oregon Business Industry

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Oregon Business 2021 100 Best Companies To Work For In Oregon

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

Altered State A Checklist For Change In New York State Empire Center For Public Policy